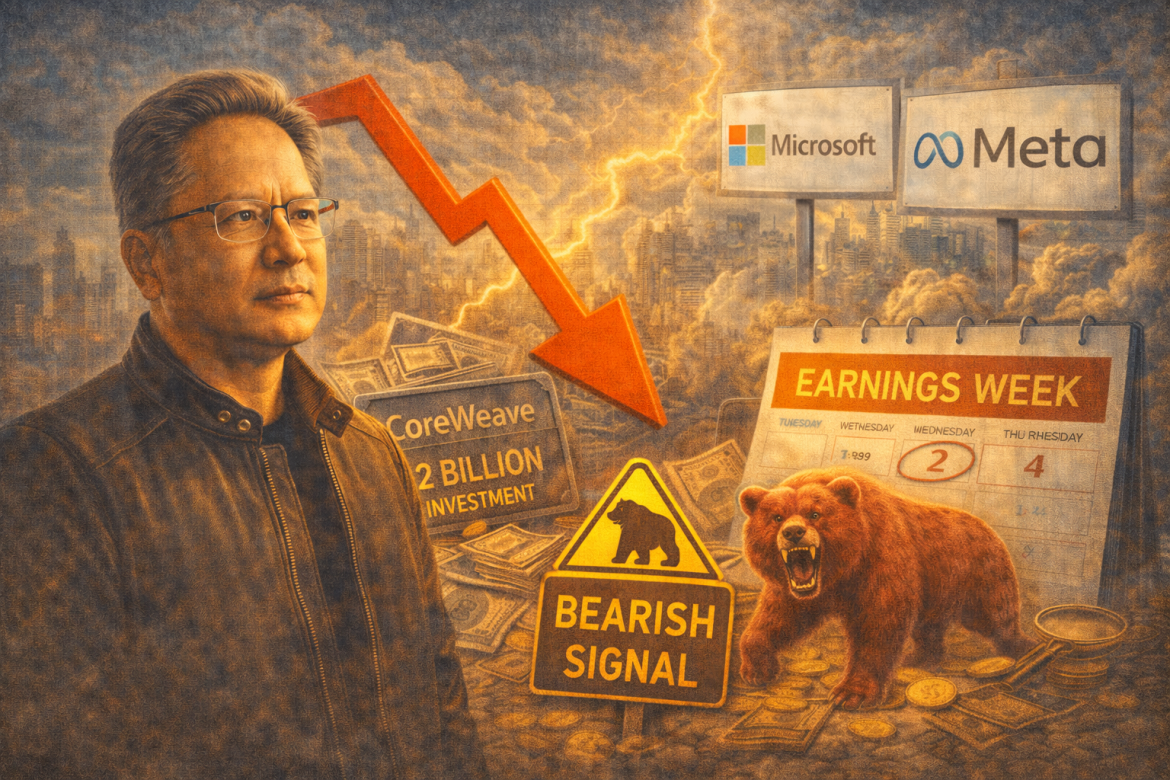

Nvidia shares traded lower on Monday as investors held back ahead of a pivotal stretch of earnings from major technology companies that could provide fresh signals on the outlook for artificial intelligence spending.

At the time of writing, the Nvidia stock was down around 0.5% to trade at $186.77.

The chipmaker’s stock slipped as markets looked ahead to results from Microsoft and Meta Platforms, both of which are scheduled to report earnings on Wednesday.

Investors are focused on whether the two companies raise their capital expenditure guidance for the year, a move that would likely reinforce expectations of sustained demand for Nvidia’s artificial intelligence chips.

Big Tech earnings seen as near-term catalyst

Microsoft and Meta are among Nvidia’s largest customers, and their spending plans are closely watched as a barometer for the broader AI investment cycle.

Any increase in projected capital expenditure would suggest heavier spending on data centres, computing infrastructure and advanced accelerators, areas where Nvidia remains the dominant supplier.

“While AI capex growth is likely to slow in percentage terms, we still expect robust spending and significant absolute growth in the coming years,” wrote Mark Haefele, chief investment officer at UBS Global Wealth Management, in a research note.

UBS analysts estimate that global AI capital expenditure will grow at an average annual rate of 25% between 2025 and 2030, reaching a run rate of about $1.3 trillion a year.

Even so, investors are increasingly debating whether Nvidia’s stock has become so crowded that additional spending commitments may not translate into outsized gains for the shares.

Haefele cautioned that the leadership of the AI trade could evolve.

“We believe that the leadership of the AI trade will broaden, from the semiconductor firms in the enabling layer that have led the rally in recent years, toward the companies in the application layer selling AI solutions to consumers and businesses,” he wrote.

New AI tools for weather forecasting

Alongside the market focus on earnings, Nvidia announced a new set of open-source software tools and models aimed at expanding the use of artificial intelligence beyond traditional data centre workloads.

The company said its new Earth-2 platform is designed to help governments and businesses build their own advanced weather forecasting systems using AI and complex data.

The platform includes two AI-based weather models intended to generate more accurate two-week forecasts and short-term “nowcasts,” which predict where storms and other severe weather events could strike up to six hours in advance.

Earth-2 also features a new data assimilation model that Nvidia said can rapidly compute key snapshots of the planet’s temperature, wind and air pressure.

These so-called “initial conditions” are essential for launching custom weather forecasts and are traditionally expensive and time-consuming to generate using conventional computing methods.

Nvidia said the platform is designed to make high-resolution weather modelling more accessible and efficient, potentially opening new markets for AI adoption in climate science, infrastructure planning and disaster preparedness.

CoreWeave investment draws attention

Nvidia also disclosed that it has invested an additional $2 billion in cloud computing firm CoreWeave, deepening its relationship with one of its largest customers and partners.

The move adds to a series of financing arrangements between Nvidia and AI infrastructure companies that have drawn scrutiny from investors concerned about circular funding and inflated valuations.

Nvidia purchased CoreWeave Class A common stock at $87.20 per share, the companies said.

The investment is intended to support CoreWeave’s plans to add more than 5 gigawatts of AI computing capacity by 2030.

As part of the expanded collaboration, CoreWeave will be among the first customers to deploy Nvidia’s forthcoming products, including new storage systems and a central processing unit.

Nvidia, which was already an investor in CoreWeave, has also agreed to purchase more than $6 billion in services from the cloud provider through 2032.

“The investment is confidence in their growth and confidence in CoreWeave’s management and confidence in their business model,” Nvidia Chief Executive Officer Jensen Huang said in an interview.

He added that the partnership is primarily about aligning engineering efforts and accelerating the deployment of computing capacity rather than financial returns alone.

The post Nvidia stock is down in the red: can bulls reignite a rally this week? appeared first on Invezz